Gain... what is it?

-

jkeeb

- Pirate Judge of Which Things Work

- Posts: 321

- Joined: Thu Jan 22, 2004 6:13 pm

- Location: Atlanta, GA

-

ShadesOfKnight

No it doesn't. Taxes become a cost of doing business, just like any other. You owe 10% of $15, since that's your "income."jkeeb wrote:Sure that's easy and short. So a Retailer sells a pair of jeans that costs $8 for $15. He owes 10% of $7 or $15?

So you must have cost of goods sold. What about salaries, other expenses? Gets complicated quick.

Simple, and efficient.

But that's not how this law is written (even my cursory examination shows me that), which begs the question of why... cui bono?

-

Demosthenes

- Grand Exalted Keeper of Esoterica

- Posts: 5773

- Joined: Wed Jan 29, 2003 3:11 pm

They can write it anyway that want, and no matter how they write, a whole bunch of internet gurus will try to sell you books and packages telling you what the secret meaning of those plain words is...

Section 1 isn't exactly rocket science:

Section 1 isn't exactly rocket science:

§ 1. Tax imposed

There is hereby imposed on the taxable income of every individual ... a tax determined in accordance with the following table :

If Taxable Income Is: The Tax Is:

Not over $7,825 = 10% of the taxable income

Over $7,825 but not over $31,850 = $782.50 plus 15% of the excess over $7,825

Over $31,850 but not over $77,100 = $4,386.25 plus 25% of the excess over $31,850

Over $77,100 but not over $160,850 = $15,698.75 plus 28% of the excess over $77,100

Over $160,850 but not over $349,700 = $39,148.75 plus 33% of the excess over $160,850

Over $349,700 = $101,469.25 plus 35% of the excess over $349,700

Last edited by Demosthenes on Tue May 01, 2007 9:02 pm, edited 1 time in total.

-

ShadesOfKnight

Neither is the Tax Code for Puerto Rico...Demosthenes wrote:They can write it anyway that want, and no matter how they write, a whole bunch of internet gurus will try to sell you books and packages telling you what the secret meaning of those plain words is...

Section 1 isn't exactly rocket science:

And one must wonder why these two examples didn't just become the whole of the thing.

-

John J. Bulten

Re: Gain... what is it?

Agreed. You have an affirmative duty to file and pay income taxes on all your income. But if income is gain and you have no gain, you have a duty to pay nothing.jg wrote:Beware those that claim you do not have an affirmative duty to file and pay income taxes.

Beware also folks like JG who repeat and repeat claims that you have an affirmative duty to pay whatever they say you have to. Shades, if you have any specific questions about JG's cites, please post them here or at http://www.losthorizons.com/Forum3/forum.asp?FORUM_ID=3 , as I have answered them before. But rather than start with those, it would be wiser to start with the facts about what information returns (W-2, 1099, etc.) you received in Jan and what they testify about you. For instance, did you know that the W-2 testifies in box 1 that you received a certain amount of 3401(a) "wages", and in box 3 that you received a certain amount of 3121(a) "wages"?

Your point about preferring brevity in the law is well-meant, and the verbiage of the ages is no boon to the tax law. In fact the first real income tax law in 1862 assessed the whole income tax in a couple hundred words in Section 90, about as clearly as you just did hypothetically. There was also a salary tax in Section 86 on the pay of government workers equally brief, and it was presumed everybody knew the difference between salary duty and income duty. But I'm getting ahead of the story. Read Cracking the Code for more.

-

Demosthenes

- Grand Exalted Keeper of Esoterica

- Posts: 5773

- Joined: Wed Jan 29, 2003 3:11 pm

The vast majority of the Code doesn't apply to you, so why do you care what it says.ShadesOfKnight wrote:Neither is the Tax Code for Puerto Rico...Demosthenes wrote:They can write it anyway that want, and no matter how they write, a whole bunch of internet gurus will try to sell you books and packages telling you what the secret meaning of those plain words is...

Section 1 isn't exactly rocket science:

And one must wonder why these two examples didn't just become the whole of the thing.

I posted Section 1. Was it unclear to you?

-

Demosthenes

- Grand Exalted Keeper of Esoterica

- Posts: 5773

- Joined: Wed Jan 29, 2003 3:11 pm

Re: Gain... what is it?

What a shocker. John is a tax protester who wants you to buy a book from his internet guru to help you learn the secret meaning of the magic words in the Code...John J. Bulten wrote:But I'm getting ahead of the story. Read Cracking the Code for more.

-

ShadesOfKnight

Two replies:Demosthenes wrote:The vast majority of the Code doesn't apply to you, so why do you care what it says.

I posted Section 1. Was it unclear to you?

1) I care because in order for me to know if it applies, I have to understand it all, do I not? Or shall I simply take your word for it?

2) No, it was not. And I very much wish that that was the whole of it. But it is not, and so I am forced to examine it all.

-

ShadesOfKnight

-

Quixote

- Quatloosian Master of Deception

- Posts: 1542

- Joined: Wed Mar 19, 2003 2:00 am

- Location: Sanhoudalistan

No. You are not a corporation, a trust, or an exempt organization, so huge swaths of the IRC don't apply to you. If you always file correct returns and pay on time, most of the procedral sections will be of no interest to you. In fact, everything you need to know about income taxes is probably in the instructions to Form 1040.I care because in order for me to know if it applies, I have to understand it all, do I not?

"Here is a fundamental question to ask yourself- what is the goal of the income tax scam? I think it is a means to extract wealth from the masses and give it to a parasite class." Skankbeat

-

Imalawman

- Enchanted Consultant of the Red Stapler

- Posts: 1808

- Joined: Tue Sep 05, 2006 8:23 pm

- Location: Formerly in a cubicle by the window where I could see the squirrels, and they were married.

Last saturday night I ate dinner with the 400th or so richest man in the world. It was very interesting talking with him about the secret to his success. Not surprisingly, the main themes were hard work and attention to detail. He also said to stay within the law. Interesting that he didn't say, "spend as much time as possible attempting to decipher the tax codes without professional legal help". At least I get paid for reading and deciphering tax codes, if I didn't, I certainly wouldn't make it my hobby.

"Some people are like Slinkies ... not really good for anything, but you can't help smiling when you see one tumble down the stairs" - Unknown

-

ShadesOfKnight

Ah... Have faith, in other words. Surely you know how difficult and indeed unlikely it is for an Agnostic to have faith?Quixote wrote:No. You are not a corporation, a trust, or an exempt organization, so huge swaths of the IRC don't apply to you. If you always file correct returns and pay on time, most of the procedral sections will be of no interest to you. In fact, everything you need to know about income taxes is probably in the instructions to Form 1040.I care because in order for me to know if it applies, I have to understand it all, do I not?

-

ShadesOfKnight

And folk like the 400th wealthiest man in the world have enough money to afford your fees (and your protection if/when the government decides to audit)... So I guess that sure does work out nicely, doesn't it?Imalawman wrote:Interesting that he didn't say, "spend as much time as possible attempting to decipher the tax codes without professional legal help". At least I get paid for reading and deciphering tax codes, if I didn't, I certainly wouldn't make it my hobby.

-

ShadesOfKnight

If that $200 per day (after taxes, I assume?) is almost wholly consumed by my costs of living (say I have a family of six including myself), then I can either spend my free time (when I'm not earning that $200), or I can go and get a second job just to pay the other guy... And, by the way, there's no real assurance either way.CaptainKickback wrote:You miss the point. The point is that you have to efficiently use your time and money on things - whether it is a bathroom remodel, car engine rebuild, or taxes.

Depending on your skill level and more importatnly, what your time is worth, hiring someone to do the job for you may be the way to go.

Example: You ern $200 per day and have a tax problem. Now you can spend a couple of weeks trying to solve it yourself and because you aren't working, lose out on $2,000. Or you can work during that period and pay someone $1,000 to solve the problem. Going solo costs you $2,000, paying someone only $1,000.

Which route do you go?

One costs me the time for a second job, one doesn't, and neither one provides a guarantee of any kind (not even better odds, if you look at it critically). Which one seems better?

-

ShadesOfKnight

Hey, YOU'RE the one who put me in the situation to start with, saying that I had a $2000 tax problem! Don't get insulting with me because I'm trying to solve the problem you gave me.CaptainKickback wrote:Then there are the hard-headed knuckle dragger who choose the most tortuous path possible to reach a wrong answer.

Or maybe you forgot about the dilemma you postulated to start with??

-

webhick

- Illuminati Obfuscation: Black Ops Div

- Posts: 3994

- Joined: Tue Jan 23, 2007 1:41 am

Re: Gain... what is it?

Code: Select all

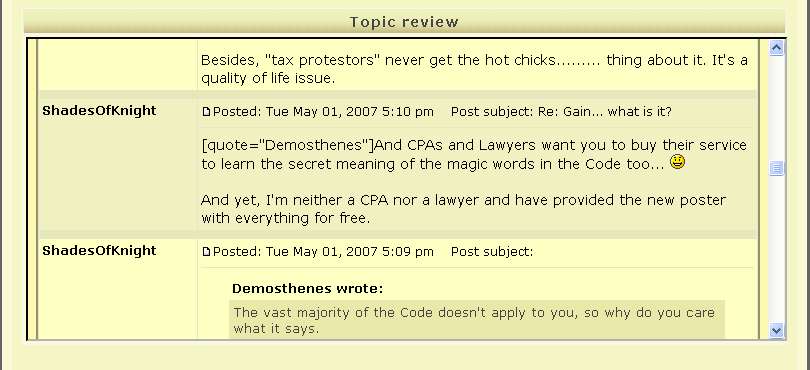

[quote="Demosthenes"]And CPAs and Lawyers want you to buy their service to learn the secret meaning of the magic words in the Code too... :)

And yet, I'm neither a CPA nor a lawyer and have provided the new poster with everything for free.I thought you were the new poster? Am I lost or something?

BTW, I went back to crawl the thread to find any references to what you said, and the post appears to be missing. Lemme include a screenshot of the post as it stood when I hit the reply button (it's from the topic review below the reply box):

Am I going nuts?

When chosen for jury duty, tell the judge "fortune cookie says guilty" - A fortune cookie

-

ShadesOfKnight

Re: Gain... what is it?

Somehow my post got mangled and the quote box isn't formed right... I must have mis-coded the quotes in my reply.webhick wrote:ShadesOfKnight - I've been following this thread... Is that you saying that you "provided the new poster with everything for free"?

I thought you were the new poster? Am I lost or something?

Sorry for the confusion.

-

webhick

- Illuminati Obfuscation: Black Ops Div

- Posts: 3994

- Joined: Tue Jan 23, 2007 1:41 am

Re: Gain... what is it?

No problem. I'm curious though. It's obviously two different posters in there. Who said the first part and who said the second?ShadesOfKnight wrote:Somehow my post got mangled and the quote box isn't formed right... I must have mis-coded the quotes in my reply.webhick wrote:ShadesOfKnight - I've been following this thread... Is that you saying that you "provided the new poster with everything for free"?

I thought you were the new poster? Am I lost or something?

Sorry for the confusion.

When chosen for jury duty, tell the judge "fortune cookie says guilty" - A fortune cookie

-

Demosthenes

- Grand Exalted Keeper of Esoterica

- Posts: 5773

- Joined: Wed Jan 29, 2003 3:11 pm

-

Duke2Earl

- Eighth Operator of the Delusional Mooloo

- Posts: 636

- Joined: Fri May 16, 2003 10:09 pm

- Location: Neverland

Speaking about lies and liars.... put the "Tax Honesty" persons at the front of the line. The real truth is whether you understand it or not if you have sufficient income and fail to pay income tax and you get caught, your life as you know it will be ruined. Just ask Ms. Kuglin who will be living in poverty on a tiny fraction of her wages until hell freezes over. And the "Tax Honesty" types are the very worst of the lot because in order to justify their illegal activities they are willing, in fact, anxious to ruin your life too.

If you want to destroy your own life, there must be better ways.

And why is this all true? Because every court in the land says so. Case closed... end of story. But if every court in the land for over 90 years can't convince you.... then there is no point in discussing it further.

If you want to destroy your own life, there must be better ways.

And why is this all true? Because every court in the land says so. Case closed... end of story. But if every court in the land for over 90 years can't convince you.... then there is no point in discussing it further.