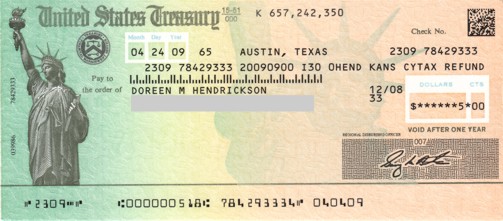

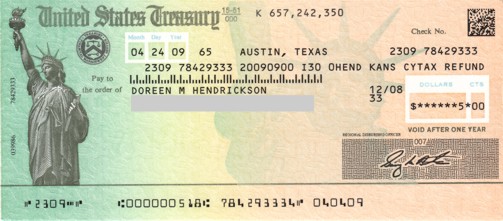

Doreen Hendrickson's $5.00 victory!

-

Quixote

- Quatloosian Master of Deception

- Posts: 1542

- Joined: Wed Mar 19, 2003 2:00 am

- Location: Sanhoudalistan

Doreen Hendrickson's $5.00 victory!

On her 2008 returnDoreen Hendrickson said she was single. For a second I thought she might have dumped Pete, but the filing status is probably just one more lie on her return. She got a $5.00 refund. It is posted as yet another CTC victory.

That $5.00 check is slightly less pathetic than the offset notices posted by Lucinda Shephard. The overpayments referred to in the notices cannot be from prepaid credits (withholding, etc.) and are probably proceeds from a bank levy that were not allocated properly.

That $5.00 check is slightly less pathetic than the offset notices posted by Lucinda Shephard. The overpayments referred to in the notices cannot be from prepaid credits (withholding, etc.) and are probably proceeds from a bank levy that were not allocated properly.

"Here is a fundamental question to ask yourself- what is the goal of the income tax scam? I think it is a means to extract wealth from the masses and give it to a parasite class." Skankbeat

-

The Observer

- Further Moderator

- Posts: 7506

- Joined: Thu Feb 06, 2003 11:48 pm

- Location: Virgin Islands Gunsmith

Re: Doreen Hendrickson's $5.00 victory!

You have failed to do the proper math according to the CtC method, so it is no wonder that you think that a $5.00 refund is pathetic. Now please pay close attention as I step you through the calculation:

(1) It is a well known fact that a loss for any CtCer in court is counted as a victory.

(2) Any reasonable person would agree that it is preferable to be given $5.00, even temporarily, than to go to jail on a conviction

(3) So it follows that a $5.00 refund must be bigger than a victory and therefore cannot be pathetic.

(1) It is a well known fact that a loss for any CtCer in court is counted as a victory.

(2) Any reasonable person would agree that it is preferable to be given $5.00, even temporarily, than to go to jail on a conviction

(3) So it follows that a $5.00 refund must be bigger than a victory and therefore cannot be pathetic.

"I could be dead wrong on this" - Irwin Schiff

"Do you realize I may even be delusional with respect to my income tax beliefs? " - Irwin Schiff

"Do you realize I may even be delusional with respect to my income tax beliefs? " - Irwin Schiff

-

jg

- Fed Chairman of the Quatloosian Reserve

- Posts: 614

- Joined: Wed Feb 25, 2004 1:25 am

Re: Doreen Hendrickson's $5.00 victory!

Although it is not clear where the $5 payment was made, this return seems to be in violation of the court order:

Why bother to issue an injunction if it will not be enforced? Or, does it have no teeth?

The order can be seen at http://www.usdoj.gov/tax/Hendrickson_Am ... ermInj.pdfAccordingly, it is hereby

ORDERED, that Defendants are prohibited from filing any tax return, amended return, form (including, but not limited to Form 4852 (“Substitute for Form W-2 Wage and Tax Statement, etc.”)) or other writing or paper with the IRS that is based on the false and frivolous claims set forth in Cracking the Code that only federal, state or local government workers are liable for the payment of federal income tax or subject to the withholding of federal income, social security and Medicare taxes from their wages under the internal revenue laws (26 U.S.C.); and it is further

ORDERED, that within 30 days of the entry of this Amended Judgment and

Order of Permanent Injunction, Defendants will file amended U.S. Individual Income Tax

Returns for the taxable years ending on December 31, 2002 and December 31, 2003

with the Internal Revenue Service...

Why bother to issue an injunction if it will not be enforced? Or, does it have no teeth?

“Where there is an income tax, the just man will pay more and the unjust less on the same amount of income.” — Plato

-

Demosthenes

- Grand Exalted Keeper of Esoterica

- Posts: 5773

- Joined: Wed Jan 29, 2003 3:11 pm

Re: Doreen Hendrickson's $5.00 victory!

Hmm. I wonder why all of the standard info on the form was typed in (First name, middle initial, SSN, address, etc.) but the last name of Hendrickson was written in later.

Demo.

-

The Observer

- Further Moderator

- Posts: 7506

- Joined: Thu Feb 06, 2003 11:48 pm

- Location: Virgin Islands Gunsmith

Re: Doreen Hendrickson's $5.00 victory!

If the printed information was the result of using software, it may be as simple as Doreen (or whoever entered the information) failing to provide her last name. Then when the return was printed out, the omission was noted and the last name was written in. The best argument against that scenario is that most tax return prep packages would check for that omission and not let the user omit the last name.

"I could be dead wrong on this" - Irwin Schiff

"Do you realize I may even be delusional with respect to my income tax beliefs? " - Irwin Schiff

"Do you realize I may even be delusional with respect to my income tax beliefs? " - Irwin Schiff

-

Quixote

- Quatloosian Master of Deception

- Posts: 1542

- Joined: Wed Mar 19, 2003 2:00 am

- Location: Sanhoudalistan

Re: Doreen Hendrickson's $5.00 victory!

The last name on the signature lines on both forms is definitely not Hendrickson.

"Here is a fundamental question to ask yourself- what is the goal of the income tax scam? I think it is a means to extract wealth from the masses and give it to a parasite class." Skankbeat

-

webhick

- Illuminati Obfuscation: Black Ops Div

- Posts: 3994

- Joined: Tue Jan 23, 2007 1:41 am

Re: Doreen Hendrickson's $5.00 victory!

I initially thought that she might have used her maiden name for the IRS submission and then whited it out and handwrote her married name for website submission, but the check is written out to her married name. Now, I just think that there was a typo in the name and she hand corrected it, rather than reprint the return.The Observer wrote:If the printed information was the result of using software, it may be as simple as Doreen (or whoever entered the information) failing to provide her last name. Then when the return was printed out, the omission was noted and the last name was written in. The best argument against that scenario is that most tax return prep packages would check for that omission and not let the user omit the last name.

When chosen for jury duty, tell the judge "fortune cookie says guilty" - A fortune cookie

-

Imalawman

- Enchanted Consultant of the Red Stapler

- Posts: 1808

- Joined: Tue Sep 05, 2006 8:23 pm

- Location: Formerly in a cubicle by the window where I could see the squirrels, and they were married.

Re: Doreen Hendrickson's $5.00 victory!

My first impression - maybe Doreen wants out and is refusing to violate the court order, so her return was done "for her". Just a suspicious mind at work....Quixote wrote:The last name on the signature lines on both forms is definitely not Hendrickson.

"Some people are like Slinkies ... not really good for anything, but you can't help smiling when you see one tumble down the stairs" - Unknown

-

webhick

- Illuminati Obfuscation: Black Ops Div

- Posts: 3994

- Joined: Tue Jan 23, 2007 1:41 am

Re: Doreen Hendrickson's $5.00 victory!

I agree, but the check is made out to Hendrickson.Quixote wrote:The last name on the signature lines on both forms is definitely not Hendrickson.

Then that would it only plausible if the return cleared fine with the wrong name, but was caught before the check was cut. In any case, I imagine that would have raised red flags somewhere.

Anyone else think it's a little sad that Doreen only earned like $70 last year?

When chosen for jury duty, tell the judge "fortune cookie says guilty" - A fortune cookie

-

Quixote

- Quatloosian Master of Deception

- Posts: 1542

- Joined: Wed Mar 19, 2003 2:00 am

- Location: Sanhoudalistan

Re: Doreen Hendrickson's $5.00 victory!

I agree, but the check is made out to Hendrickson.webhick wrote:Quixote wrote:The last name on the signature lines on both forms is definitely not Hendrickson.

Then that would it only plausible if the return cleared fine with the wrong name, but was caught before the check was cut. In any case, I imagine that would have raised red flags somewhere.

All that means is that the name was changed to Hendrickson before the return was filed.

"Here is a fundamental question to ask yourself- what is the goal of the income tax scam? I think it is a means to extract wealth from the masses and give it to a parasite class." Skankbeat

-

LPC

- Trusted Keeper of the All True FAQ

- Posts: 5233

- Joined: Sun Mar 02, 2003 3:38 am

- Location: Earth

Re: Doreen Hendrickson's $5.00 victory!

Two questions that just occurred to me:

1. Why isn't Doreen on the list of "frivolous filers" that the IRS has supposedly been keeping, and why wasn't her return caught for that reason alone?

2. Why is the IRS sending her a check for a refund while it has a judgment against her for an erroneous refund?

1. Why isn't Doreen on the list of "frivolous filers" that the IRS has supposedly been keeping, and why wasn't her return caught for that reason alone?

2. Why is the IRS sending her a check for a refund while it has a judgment against her for an erroneous refund?

Dan Evans

Foreman of the Unified Citizens' Grand Jury for Pennsylvania

(And author of the Tax Protester FAQ: evans-legal.com/dan/tpfaq.html)

"Nothing is more terrible than ignorance in action." Johann Wolfgang von Goethe.

Foreman of the Unified Citizens' Grand Jury for Pennsylvania

(And author of the Tax Protester FAQ: evans-legal.com/dan/tpfaq.html)

"Nothing is more terrible than ignorance in action." Johann Wolfgang von Goethe.

-

Quixote

- Quatloosian Master of Deception

- Posts: 1542

- Joined: Wed Mar 19, 2003 2:00 am

- Location: Sanhoudalistan

Re: Doreen Hendrickson's $5.00 victory!

1. If there ever were a list, RRA98 would have made it contraband.LPC wrote:Two questions that just occurred to me:

1. Why isn't Doreen on the list of "frivolous filers" that the IRS has supposedly been keeping, and why wasn't her return caught for that reason alone?

2. Why is the IRS sending her a check for a refund while it has a judgment against her for an erroneous refund?

2. The following applies to offsets under IRC §6402(c).

IRM 21.4.6.4.2.4 (revised 01-01-2001)TOP Offset Tolerance

Any refund under $25 is not offset by TOP. This tolerance applies to both IMF and BMF.

I did not find a similar tolerance for offsets under IRC §6402(a), but it seems likely that there is one.

"Here is a fundamental question to ask yourself- what is the goal of the income tax scam? I think it is a means to extract wealth from the masses and give it to a parasite class." Skankbeat

-

jkeeb

- Pirate Judge of Which Things Work

- Posts: 321

- Joined: Thu Jan 22, 2004 6:13 pm

- Location: Atlanta, GA

Re: Doreen Hendrickson's $5.00 victory!

$25 is probably less than the cost of offset notices. IRS is smart to go ahead and refund.

Kinda like if Bill Gates, during his better years, would be better off not picking a $100 bill off the ground.

Kinda like if Bill Gates, during his better years, would be better off not picking a $100 bill off the ground.

Remember that CtC is about the rule of law.

John J. Bulten

John J. Bulten

-

LPC

- Trusted Keeper of the All True FAQ

- Posts: 5233

- Joined: Sun Mar 02, 2003 3:38 am

- Location: Earth

Re: Doreen Hendrickson's $5.00 victory!

There is a "frivolous return program" that is described (and approved) in IRS National Center Service Advice No. 200107034 (2/16/2001). I had thought that the program identified not only frivolous returns and frivolous arguments, but also frivolous filers. I may be mistaken.Quixote wrote:1. If there ever were a list, RRA98 would have made it contraband.LPC wrote:Two questions that just occurred to me:

1. Why isn't Doreen on the list of "frivolous filers" that the IRS has supposedly been keeping, and why wasn't her return caught for that reason alone?

That makes sense.Quixote wrote:2. The following applies to offsets under IRC §6402(c).LPC wrote:2. Why is the IRS sending her a check for a refund while it has a judgment against her for an erroneous refund?IRM 21.4.6.4.2.4 (revised 01-01-2001)TOP Offset Tolerance

Any refund under $25 is not offset by TOP. This tolerance applies to both IMF and BMF.

I did not find a similar tolerance for offsets under IRC §6402(a), but it seems likely that there is one.

It also occurred to me that, because of arcane technical-legal stuff (that you would think that I would like, but actually don't always), the IRS can offset tax refunds against other taxes *assessed*, but not other taxes for which there are *judgments* without assessments. (Not saying that's true, but just that it's a possibility that occurred to me.)

Dan Evans

Foreman of the Unified Citizens' Grand Jury for Pennsylvania

(And author of the Tax Protester FAQ: evans-legal.com/dan/tpfaq.html)

"Nothing is more terrible than ignorance in action." Johann Wolfgang von Goethe.

Foreman of the Unified Citizens' Grand Jury for Pennsylvania

(And author of the Tax Protester FAQ: evans-legal.com/dan/tpfaq.html)

"Nothing is more terrible than ignorance in action." Johann Wolfgang von Goethe.

-

jcolvin2

- Grand Master Consul of Quatloosia

- Posts: 825

- Joined: Tue Jul 01, 2003 3:19 am

- Location: Seattle

Re: Doreen Hendrickson's $5.00 victory!

I think it would be a very rare set of circumstances in which there would be a judgment without an assessment. Ordinarily, the existence of an assessment is necessary for the IRS to obtain a judgment. In a suit to reduce an assessment to judgment, the taxpayer ordinarily can can challenge the assessment on the merits (whether or not the original proposed assessment was contested in response to a SNOD). Perhaps there may be some circumstances in bankruptcy where there are no administrative assessments, but judgments are entered. However, I am not familiar with such situations.LPC wrote: It also occurred to me that, because of arcane technical-legal stuff (that you would think that I would like, but actually don't always), the IRS can offset tax refunds against other taxes *assessed*, but not other taxes for which there are *judgments* without assessments. (Not saying that's true, but just that it's a possibility that occurred to me.)

-

LPC

- Trusted Keeper of the All True FAQ

- Posts: 5233

- Joined: Sun Mar 02, 2003 3:38 am

- Location: Earth

Re: Doreen Hendrickson's $5.00 victory!

My recollection/understanding is that the US sued Hendrickson for recovery of an erroneous refund without first assessing any deficiency.jcolvin2 wrote:I think it would be a very rare set of circumstances in which there would be a judgment without an assessment.LPC wrote: It also occurred to me that, because of arcane technical-legal stuff (that you would think that I would like, but actually don't always), the IRS can offset tax refunds against other taxes *assessed*, but not other taxes for which there are *judgments* without assessments. (Not saying that's true, but just that it's a possibility that occurred to me.)

Dan Evans

Foreman of the Unified Citizens' Grand Jury for Pennsylvania

(And author of the Tax Protester FAQ: evans-legal.com/dan/tpfaq.html)

"Nothing is more terrible than ignorance in action." Johann Wolfgang von Goethe.

Foreman of the Unified Citizens' Grand Jury for Pennsylvania

(And author of the Tax Protester FAQ: evans-legal.com/dan/tpfaq.html)

"Nothing is more terrible than ignorance in action." Johann Wolfgang von Goethe.

-

Imalawman

- Enchanted Consultant of the Red Stapler

- Posts: 1808

- Joined: Tue Sep 05, 2006 8:23 pm

- Location: Formerly in a cubicle by the window where I could see the squirrels, and they were married.

Re: Doreen Hendrickson's $5.00 victory!

Please correct me, but I thought that if you let the 90-day letter lapse, then the deficiency is assessed via a form 26 (or something like that). Then you can sue for a refund, based on the payment of the assessment. Thus, I thought in most cases and all cases in tax court, there hasn't been an assessment yet before there would be a court judgment. In a recovery for a wrongful refund, I'm not sure of the procedure, but it doesn't strike me as necessary that there would have to be an assessment.LPC wrote:My recollection/understanding is that the US sued Hendrickson for recovery of an erroneous refund without first assessing any deficiency.jcolvin2 wrote:I think it would be a very rare set of circumstances in which there would be a judgment without an assessment.LPC wrote: It also occurred to me that, because of arcane technical-legal stuff (that you would think that I would like, but actually don't always), the IRS can offset tax refunds against other taxes *assessed*, but not other taxes for which there are *judgments* without assessments. (Not saying that's true, but just that it's a possibility that occurred to me.)

"Some people are like Slinkies ... not really good for anything, but you can't help smiling when you see one tumble down the stairs" - Unknown

-

Quixote

- Quatloosian Master of Deception

- Posts: 1542

- Joined: Wed Mar 19, 2003 2:00 am

- Location: Sanhoudalistan

Re: Doreen Hendrickson's $5.00 victory!

IRM 3.17.80 covers recovery of erroneous refunds and collection of court ordered restititution in excruciating detail. The IRS does offset refunds to recover erroneous refunds even if there is never an assessment.

"Here is a fundamental question to ask yourself- what is the goal of the income tax scam? I think it is a means to extract wealth from the masses and give it to a parasite class." Skankbeat