$300,000 Income Tax Reward (Peymon Mottahedeh)

-

Pottapaug1938

- Supreme Prophet (Junior Division)

- Posts: 6108

- Joined: Thu Apr 23, 2009 8:26 pm

- Location: In the woods, with a Hudson Bay axe in my hands.

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

Peymon asserts:

Show me law, not crooked political judge opinions.

Sorry; but judicial opinions are not best guesses as to what a judge thinks is the law. The are authoritative and binding statements of the law. Yes, the decision in Dred Scott v. Sandford was morally disgusting; but it reflected the state of the law as it then was. Fortunately, the law was changed, during and after the Civil War.

I can easily name one modern Supreme Court case which I think was wrongly decided; but no matter how I feel about it, it is still the law, and will remain the law unless I, and others, can get it changed.

Show me law, not crooked political judge opinions.

Sorry; but judicial opinions are not best guesses as to what a judge thinks is the law. The are authoritative and binding statements of the law. Yes, the decision in Dred Scott v. Sandford was morally disgusting; but it reflected the state of the law as it then was. Fortunately, the law was changed, during and after the Civil War.

I can easily name one modern Supreme Court case which I think was wrongly decided; but no matter how I feel about it, it is still the law, and will remain the law unless I, and others, can get it changed.

"We've been attacked by the intelligent, educated segment of the culture." -- Pastor Ray Mummert, Dover, PA, during an attempt to introduce creationism -- er, "intelligent design", into the Dover Public Schools

-

NYGman

- Admiral of the Quatloosian Seas

- Posts: 2272

- Joined: Thu Sep 20, 2012 6:01 pm

- Location: New York, NY

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

And he is also implying all judges are corrupt, because we do have a system to appeal unfair judgements, as Peymon is currently doing. So of there is a corrupt judge, their ruling can be reviewed. Unless he thinks the Supreme Court is Corrupt, in which case the whole legal process is meaningless. We may not get an answer we like, or agree with, but there is a legal argument on both sides in those situations, and we get dissenting opinions. And even with the court opinions, you may get concurring decisions, which agree with the outcome but on a different basis.Pottapaug1938 wrote: ↑Wed Jun 03, 2020 1:10 pm Peymon asserts:

Show me law, not crooked political judge opinions.

Sorry; but judicial opinions are not best guesses as to what a judge thinks is the law. The are authoritative and binding statements of the law.

Point is, the court opinions are interpretations of the law. If the courts get it wrong, the legislative branch is the right place to fix it, either with legislation, or where appropriate, constitutional amendments. So you can't dismiss a legal opinion just because you don't like it.

The Hardest Thing in the World to Understand is Income Taxes -Albert Einstein

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

-

The Observer

- Further Moderator

- Posts: 7507

- Joined: Thu Feb 06, 2003 11:48 pm

- Location: Virgin Islands Gunsmith

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

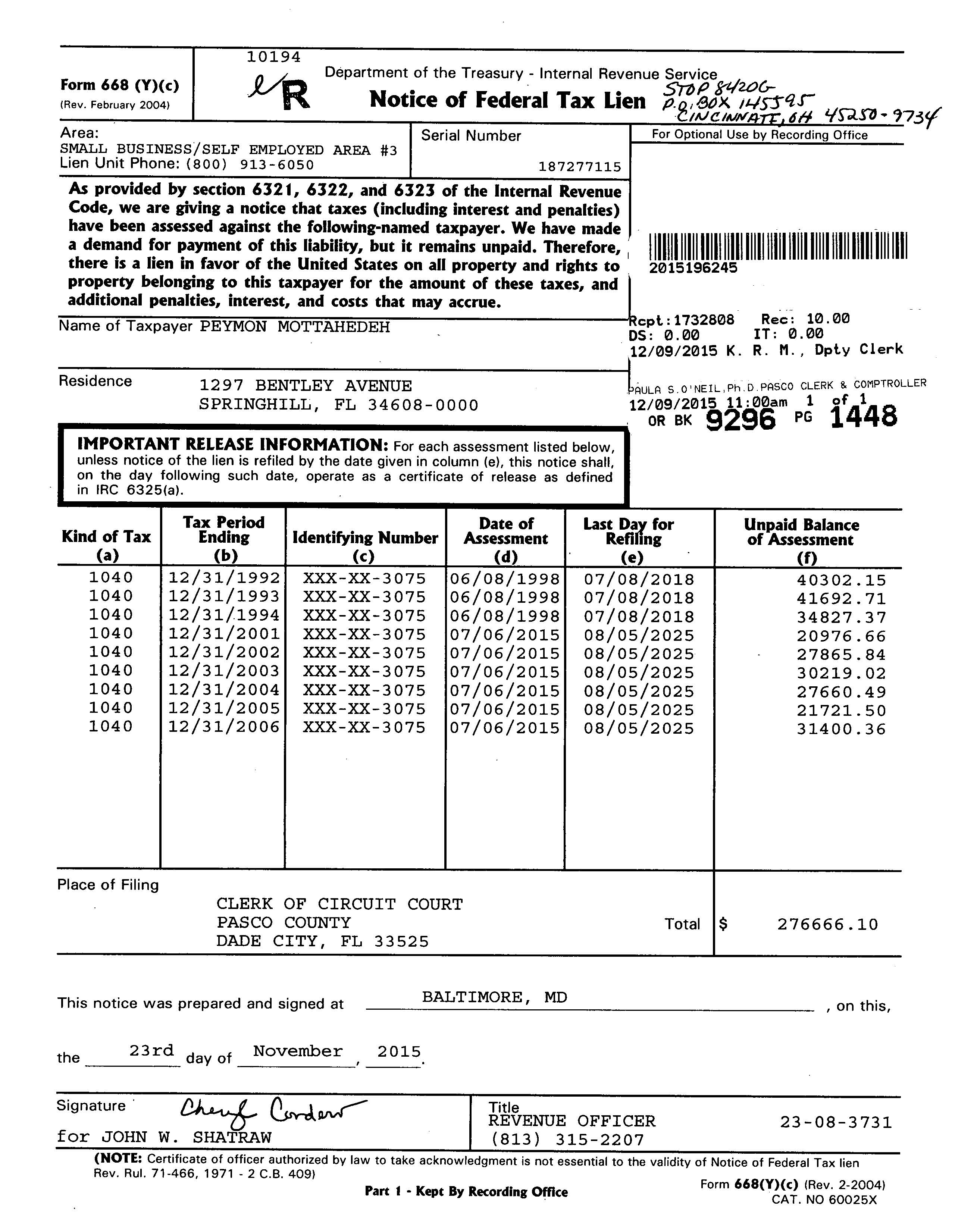

And Peymon has admitted that he himself has not been able to remove the liens that were incurred:

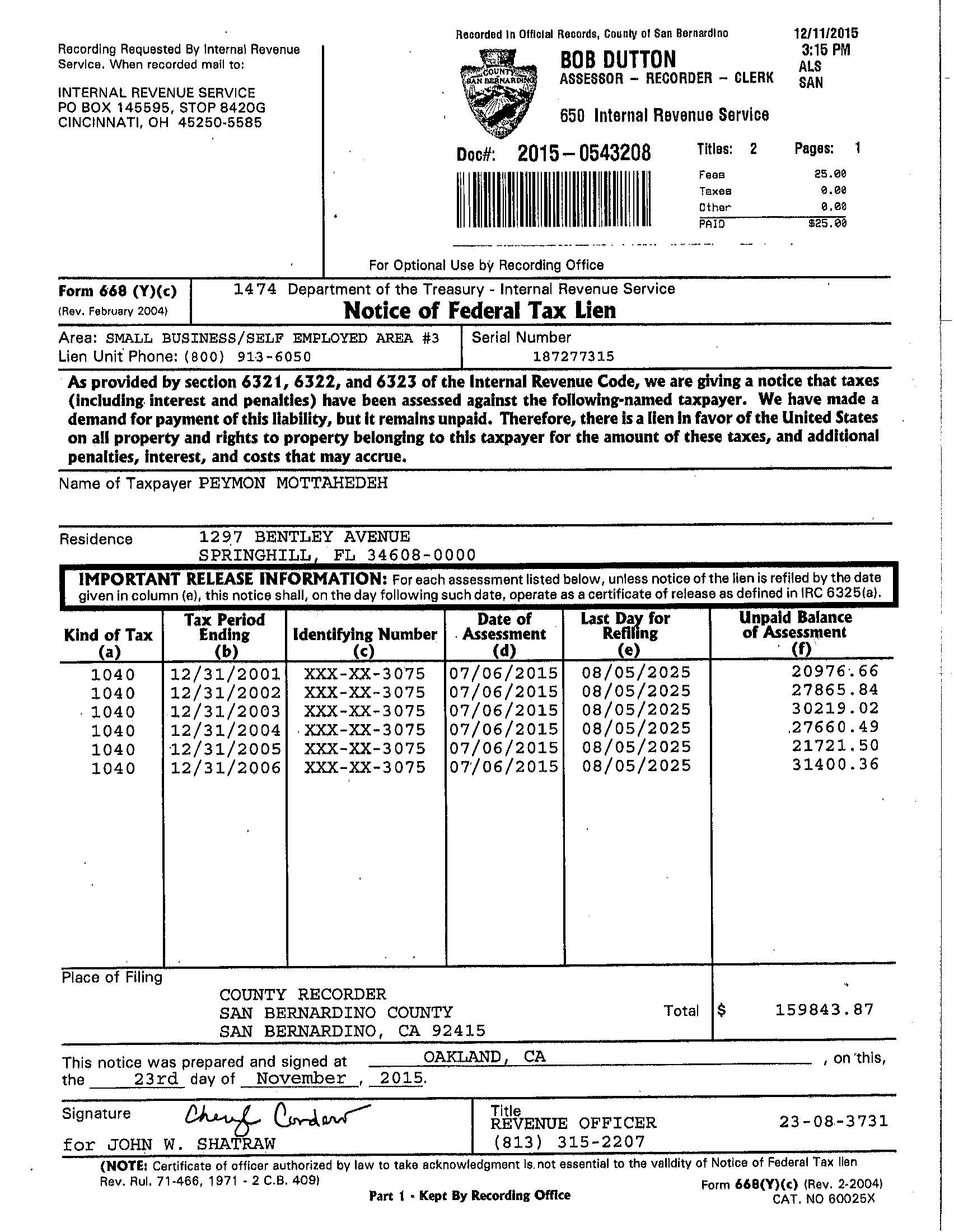

These were stupid attempts by Peymon; he should have quit while he was ahead and just focused on selling debt avoidance packages to his clients. Instead, he lures them onto the rocks with false promises and misleading stories as to how successful he has bee. He then continues to soak them for additional money by encouraging to prolong the losing fight by contesting summonses, filing for CDP hearings against assessments and collection actions, and filing court cases. Then in the end, all the client is left with is the same final tactic: debt avoidance and then the long haul of trying to repair whatever credit rating they have left over the next 7-10 years.

Which is an obtuse way of saying that the statutory period for the liens expired. Essentially Peymon had to wait out the 6 or 10 year period of collection. And that is an admission that he could not compel the courts or the government to release the liens. And that means he cannot do the same for his customers. All he can advise them to do is to stonewall, hide assets, pay on a cash basis and basically live off the grid and forgo the usual standard of living.peymon wrote:1) The tax liens for years 92-94 are very old and have fallen off.

But again, despite all his claims, again he tacitly admits that he has been unable to reverse the 2001-2006 assessments and liens that arose from those assessments. And we know where this is going to end - the same result that he obtained in his previous attempts to stop the 92-94 assessments and liens.[peymon wrote:2) The 01 to 06 years are on appeal due to government incompetence. If you really want to know more look at the tax court docket. Hold your horses until the appeal is done.

These were stupid attempts by Peymon; he should have quit while he was ahead and just focused on selling debt avoidance packages to his clients. Instead, he lures them onto the rocks with false promises and misleading stories as to how successful he has bee. He then continues to soak them for additional money by encouraging to prolong the losing fight by contesting summonses, filing for CDP hearings against assessments and collection actions, and filing court cases. Then in the end, all the client is left with is the same final tactic: debt avoidance and then the long haul of trying to repair whatever credit rating they have left over the next 7-10 years.

"I could be dead wrong on this" - Irwin Schiff

"Do you realize I may even be delusional with respect to my income tax beliefs? " - Irwin Schiff

"Do you realize I may even be delusional with respect to my income tax beliefs? " - Irwin Schiff

-

Cpt Banjo

- Fretful leader of the Quat Quartet

- Posts: 781

- Joined: Mon Nov 08, 2004 7:56 pm

- Location: Usually between the first and twelfth frets

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

That's not the issue. The fact is that a judgment for back taxes was rendered against you, despite your I'm-not-liable-for-income-tax claims to the contrary. I have no idea whether the liens have "fallen off" or not. Maybe the IRS levied on your property to satify the claim. Maybe you paid the deficiency. There's certainly no reason to believe your claim that you didn't.

Do you honestly believe the 9th Circuit is going to have a different opinion about your arguments than the Tax Court did, which found them without merit? If so, I have a beautiful orange bridge in the Bay Area for sale. Are you oblivious to the fact that your arguments are old, shopworn claptrap that have been routinely rejected by the courts as frivolous?

"Run get the pitcher, get the baby some beer." Rev. Gary Davis

-

Duke2Earl

- Eighth Operator of the Delusional Mooloo

- Posts: 636

- Joined: Fri May 16, 2003 10:09 pm

- Location: Neverland

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

The basis of the nonsense spewed here is that this person believes that he personally gets to decide what the law is and how it is applied. Sorry, it doesn't work that way and never has.

Another point, the correctness of a legal argument is not determined by the number of words used.

Another point, the correctness of a legal argument is not determined by the number of words used.

My choice early in life was to either be a piano player in a whorehouse or a politican. And to tell the truth there's hardly any difference.

Harry S Truman

Harry S Truman

-

NYGman

- Admiral of the Quatloosian Seas

- Posts: 2272

- Joined: Thu Sep 20, 2012 6:01 pm

- Location: New York, NY

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

More food for thought for the Peyman. §61(1) refers to Compensation for services. Using your logic, we can look to see that Salaries and wages are a form of earnings. The dictionary defines earnings as:

Even the Freakin' Dictionary knows that Compensation for services can define earnings, and this is interchangeable with many of the same items listed in §61. Note the bolded items, These are all covered, under (1) even though not all explicitly listed. For example, takings, honoraria, pickings, and perks are all taxable under §61, but are not listed specifically, because they do not need to be. They are already covered either under compensation for services or as items similar to.

Keep believing wages and salary are not covered under §61, then you are truly an idiot. It is clear to any rational reader of §61, that wages and salary are covered under the definition of gross income, and thus subject to tax. To deny that is like denying the existence of oxygen because you can't see it with your own eyes.

Now give me you 300k, oh right you don't have it, and will deny I am correct anyway, because, ball bearings.

Edited to add: I should sue you for the 300k, but I doubt I would win, as the construct of your offer is so vague, it probably would not hold up in court. Further, even if I win, you don't have the money to pay me, and even if you did, I think the IRS likely has higher priority than me. I guess teh best I can hope for is your reposting this on your website, likely selectively edited, with your modifications and commentary added post conversation, and removal of my comments that call you out on this and the whole scam of a "competition" you are running. For what it is worth, I do not give you permission to repost my posts, not that I think that will stop you, but I am happy for you to link your follows to the posts here, so they can read the full unedited discussion. Further any reuse of my posts should you choose to go against my express wishes, must contain proper attribution, with a link back to my source post, so your readers know what you have edited or more importantly omitted.

This isn't a win for you, it is a further loss. and just another example to illustrate your stupidity.

Definitions from Oxford Languagesearn·ings

/ˈərniNGz/

plural noun: earnings

money [Compensation] obtained in return for labor or services.

Similar: income, wages, salary, stipend, pay, take-home pay, gross pay, net pay, revenue, yield, profit, takings, proceeds, dividends, gain, return, remuneration, emolument, payment, fees, honoraria, fringe benefits, pickings, perks

Even the Freakin' Dictionary knows that Compensation for services can define earnings, and this is interchangeable with many of the same items listed in §61. Note the bolded items, These are all covered, under (1) even though not all explicitly listed. For example, takings, honoraria, pickings, and perks are all taxable under §61, but are not listed specifically, because they do not need to be. They are already covered either under compensation for services or as items similar to.

Keep believing wages and salary are not covered under §61, then you are truly an idiot. It is clear to any rational reader of §61, that wages and salary are covered under the definition of gross income, and thus subject to tax. To deny that is like denying the existence of oxygen because you can't see it with your own eyes.

Now give me you 300k, oh right you don't have it, and will deny I am correct anyway, because, ball bearings.

Edited to add: I should sue you for the 300k, but I doubt I would win, as the construct of your offer is so vague, it probably would not hold up in court. Further, even if I win, you don't have the money to pay me, and even if you did, I think the IRS likely has higher priority than me. I guess teh best I can hope for is your reposting this on your website, likely selectively edited, with your modifications and commentary added post conversation, and removal of my comments that call you out on this and the whole scam of a "competition" you are running. For what it is worth, I do not give you permission to repost my posts, not that I think that will stop you, but I am happy for you to link your follows to the posts here, so they can read the full unedited discussion. Further any reuse of my posts should you choose to go against my express wishes, must contain proper attribution, with a link back to my source post, so your readers know what you have edited or more importantly omitted.

This isn't a win for you, it is a further loss. and just another example to illustrate your stupidity.

The Hardest Thing in the World to Understand is Income Taxes -Albert Einstein

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

-

Pottapaug1938

- Supreme Prophet (Junior Division)

- Posts: 6108

- Joined: Thu Apr 23, 2009 8:26 pm

- Location: In the woods, with a Hudson Bay axe in my hands.

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

In a book which I have, I recall reading of a proponent of some brand of idiocy (I can't recall whether it was religious, pseudoscientific, legal [having to do with sovereign citizens, taxes, or whatever], or anything else) who challenged one and all to prove, to his satisfaction, that he was wrong about X. Someone accepted the challenge and, beyond a resonable doubt, that the proponent was wrong about X, and claimed the offered prize. The proponent refused to pay up. The challenger sued the proponent in court; and he lost, because the court said that the terms of the challenge required that the proponent was the sole judge of whether or not he was satisfied with the proof.

Peymon will never have to pay up on his challenge, because he can always explain away the proof, move the goalposts and claim that the proof is incomplete, and more.

Peymon will never have to pay up on his challenge, because he can always explain away the proof, move the goalposts and claim that the proof is incomplete, and more.

"We've been attacked by the intelligent, educated segment of the culture." -- Pastor Ray Mummert, Dover, PA, during an attempt to introduce creationism -- er, "intelligent design", into the Dover Public Schools

-

NYGman

- Admiral of the Quatloosian Seas

- Posts: 2272

- Joined: Thu Sep 20, 2012 6:01 pm

- Location: New York, NY

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

Exactly, I think I had the same case in mind when I posted. It is also why, a while back I referenced the Paranormal Challenge, as if I remember correctly, it actually had clear terms, and anyone accepting the challenge would actually submit the skill and work on drawing up criteria for success, with the amount of the prize escrowed, to be distributed based upon the mutually agreed success criteria. Many couldn't even agree on the success criteria, and never got to testing. No surprise, no challenger never met the testing criteria, and funds were never paid out. Not sure if they actually put up the cash, or had a bond or some form of insurance to cover, but the money was guaranteed. Peymon, however, has this nebulous offer which has vague terms, and as you point out, have him as the sole arbiter, an idiot judge, with no understanding of the law or legal concepts. It is less a legitimate offer, and more an advertising gimmick. If he really believed in the validity of his position he would escrow the 300k, and appoint an independent qualified arbiter to review both positions. If he is so confident in his position, he would not fear independent review. He is a man afraid to admit he is wrong, afraid to accept he doesn't understand something he has believed for 20+ years. All this bluster is for his own benefit, to pump himself up.Pottapaug1938 wrote: ↑Wed Jun 03, 2020 6:52 pm In a book which I have, I recall reading of a proponent of some brand of idiocy (I can't recall whether it was religious, pseudoscientific, legal [having to do with sovereign citizens, taxes, or whatever], or anything else) who challenged one and all to prove, to his satisfaction, that he was wrong about X. Someone accepted the challenge and, beyond a resonable doubt, that the proponent was wrong about X, and claimed the offered prize. The proponent refused to pay up. The challenger sued the proponent in court; and he lost, because the court said that the terms of the challenge required that the proponent was the sole judge of whether or not he was satisfied with the proof.

Peymon will never have to pay up on his challenge, because he can always explain away the proof, move the goalposts and claim that the proof is incomplete, and more.

I do wonder if, at an unconscious level, he knows he is wrong, and just can't bring his conscious to acknowledge it? At some level he must realize he isn't right.

The Hardest Thing in the World to Understand is Income Taxes -Albert Einstein

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

-

wserra

- Quatloosian Federal Witness

- Posts: 7567

- Joined: Sat Apr 26, 2003 6:39 pm

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

Are you guys thinking of the one and only (Payme here is just a pretender) Irwin Schiff? Newman v. Schiff, 778 F.2d 460 (8th Cir 1985).

"A wise man proportions belief to the evidence."

- David Hume

- David Hume

-

Pottapaug1938

- Supreme Prophet (Junior Division)

- Posts: 6108

- Joined: Thu Apr 23, 2009 8:26 pm

- Location: In the woods, with a Hudson Bay axe in my hands.

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

Not him.

"We've been attacked by the intelligent, educated segment of the culture." -- Pastor Ray Mummert, Dover, PA, during an attempt to introduce creationism -- er, "intelligent design", into the Dover Public Schools

-

NYGman

- Admiral of the Quatloosian Seas

- Posts: 2272

- Joined: Thu Sep 20, 2012 6:01 pm

- Location: New York, NY

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

Heck, it may have been a case from my contacts class back in law school, but not Schiff. But then again, I am sure the case isn't unique, I am sure there are several with the same holding.

The Hardest Thing in the World to Understand is Income Taxes -Albert Einstein

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

-

AndyK

- Illuminatian Revenue Supremo Emeritus

- Posts: 1591

- Joined: Sun Sep 11, 2011 8:13 pm

- Location: Maryland

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

One of the SFBs who published material that the Income Tax Amendment wasn't actually approved??

Too many idiots, too few bullets in the .50 Cal debunker.

Too many idiots, too few bullets in the .50 Cal debunker.

Taxes are the price we pay for a free society and to cover the responsibilities of the evaders

-

NYGman

- Admiral of the Quatloosian Seas

- Posts: 2272

- Joined: Thu Sep 20, 2012 6:01 pm

- Location: New York, NY

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

Wondering if Peymon has just slinked off, as based on the prior level of posting and responses I would have expected some response by now. He hasn't posted since Tuesday, and I think he owes a few of us some replies. However I am happy to view his silence as tacit acceptance of his ineptness, and previous failure to understand the code were just that, failures, and that his position on taxation is incorrect.

The Hardest Thing in the World to Understand is Income Taxes -Albert Einstein

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

-

Pottapaug1938

- Supreme Prophet (Junior Division)

- Posts: 6108

- Joined: Thu Apr 23, 2009 8:26 pm

- Location: In the woods, with a Hudson Bay axe in my hands.

Re: $300,000 Income Tax Reward (Peymon Mottahedeh)

Peymon is probably back on more congenial forums, bragging that he issued his challenge to us, and that none of us were willing to accept it.

"We've been attacked by the intelligent, educated segment of the culture." -- Pastor Ray Mummert, Dover, PA, during an attempt to introduce creationism -- er, "intelligent design", into the Dover Public Schools

-

NYGman

- Admiral of the Quatloosian Seas

- Posts: 2272

- Joined: Thu Sep 20, 2012 6:01 pm

- Location: New York, NY

Re: $300,000 Income Tax Reward (Peymon Mottahedeh)

I was trying to accept, but needed to better define the terms, I even offered up 10k for a charitable contribution in his name if I were to lose. All I required was for the amounts (300k/10k) to be escrowed, and an independent qualified adjudicator, with an understanding of tax law, either by being a Judge or a legal academic to review and decide who is right. However, he didn't seem to want to accept my offer, I wonder why? Oh wait, I know, because unless he is the judge and decides if an argument is right, he has no chance of winning his own competition.

The Hardest Thing in the World to Understand is Income Taxes -Albert Einstein

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

Freedom's just another word for nothing left to lose - As sung by Janis Joplin (and others) Written by Kris Kristofferson and Fred Foster.

-

The Observer

- Further Moderator

- Posts: 7507

- Joined: Thu Feb 06, 2003 11:48 pm

- Location: Virgin Islands Gunsmith

Re: $300,000 Income Tax Reward (Peymon Mottahedeh)

And his justification would be that any such person as required by your terms would be biased, corrupt and incapable of rendering the correct decision. This is same shop-worn mantra that he peddles to his marks:

The ironic thing to note here is why Peymon would pursue filing litigation and appeals against the government that would be heard by those "corrupt" judges. Since he has told his marks that anything these judges render in terms of decisions are wrong, it has to be a foregone conclusion that Peymon's cases would be pointless and a waste of time and money. Yet he bangs his head anyways against the wall and does it repeatedly. He will most likely claim that he did it to "prove" his claims of corruption, but it would seem to me that he only had to do it once. Yet he has done it several times which only risks getting the reputation of him being seen as insane because he keeps conducting the same experiment expecting at some point to get a different result.peymon wrote:...corrupt political judge[s]...

His "drive-by" here was only for one purpose as Pottapaug1938 has surmised - to create the appearance that he has once again defended his baseless claims and came out on top in order to get more money from potential marks.

"I could be dead wrong on this" - Irwin Schiff

"Do you realize I may even be delusional with respect to my income tax beliefs? " - Irwin Schiff

"Do you realize I may even be delusional with respect to my income tax beliefs? " - Irwin Schiff

-

wserra

- Quatloosian Federal Witness

- Posts: 7567

- Joined: Sat Apr 26, 2003 6:39 pm

Re: Anyone has tried to Collect the $300,000 Income Tax Reward yet?

And . . . that would be a lie. I had to do some research before writing this.

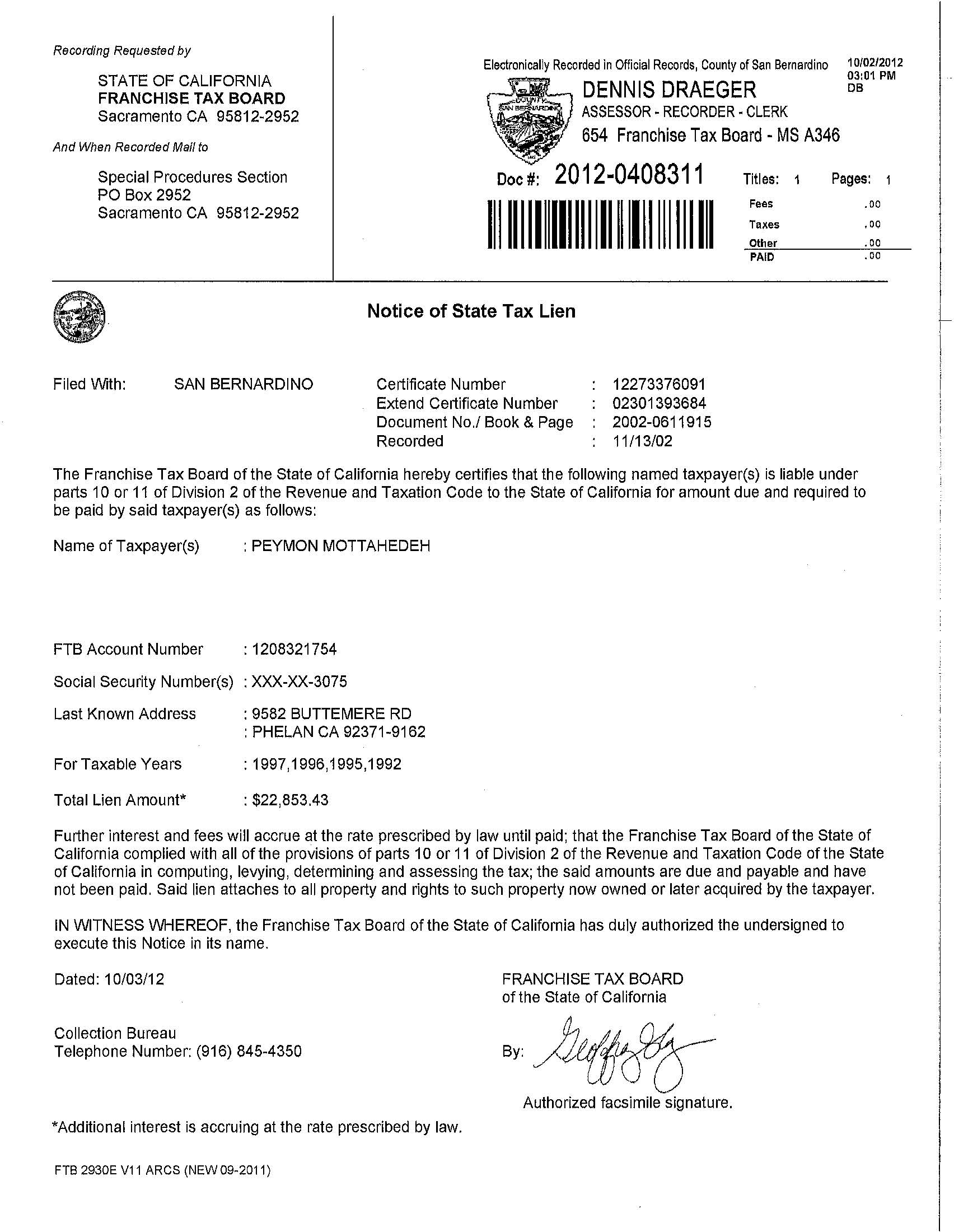

Eight or nine years ago, Mottahedeh succeeding in having a group of liens vacated on certain procedural grounds. Good for him, no problem holding govt feet to the fire. Of course, the grounds he used were not the bullshit he peddles on his site; more on that below. In fact, the IRS backed off its own liens, and the Tax Court memorialized it in an order.

Victory? Not so soon - and this is the part Mottahedeh neglects to inform the readers of his website. The govt filed new NFTLs, which included re-assessments of some of the old ones. It's worth reproducing them here, rather than just linking to them.

Pasco County, FL:

San Bernardino County, CA:

FTB (CA State):

So, Payme, it looks to me as though, as of November of 2015, you had $300K in tax liens. It's likely more now, since interest and penalties continue to accrue. But tell me: is that where you got the number for your $300K "reward"? If some court should decide that you actually owe it to someone, you just say, "Well, fight the IRS for it"? Not nice, Payme, not nice.

One more thing before we go. Once upon a time - Mottahedeh has a long history of tax liens - the govt started an action against him to reduce certain assessments to judgment. 08cv2740 (CACD). Mottahedeh does defend it, beginning by filing an answer. Funny thing about that answer: all of the happy horseshit that Payme posts here, and advertises on his web site - it's not in his answer. No "there is no law", no claim of Fifth Amendment privilege, whatever. God knows, the document is hardly a model of legal clarity; but the omissions are striking.

As is usually the case in actions of this type, the govt moves for summary judgment. Mottahedeh opposes it. Probably most (or all) of the readers understand this, but summary judgment is where the rubber meets the road. If the govt wins, the case is basically over. Therefore one opposes summary judgment with everything one has. So here is when Mottahedeh pulls out the big guns, right? That stuff that he's so good at that he can charge a lot for it? Wrong. He presents technical arguments - losing technical arguments - only. Whassamatta, Payme? That nonsense good enough for the marks, but not for you?

Coda: govt, of course, gets summary judgment. Judgment filed against Mottahedeh. Ninth Circuit dismisses appeal because Mottahedeh blew the notice of appeal date.

So go ahead, people, give this guy money. Goddam Clarence Darrow.

"A wise man proportions belief to the evidence."

- David Hume

- David Hume

-

AndyK

- Illuminatian Revenue Supremo Emeritus

- Posts: 1591

- Joined: Sun Sep 11, 2011 8:13 pm

- Location: Maryland

Re: $300,000 Income Tax Reward (Peymon Mottahedeh)

If anyone desires to waste mote time, they can research Peymon's stellar victory over the IRS in getting liens released.

The liens related to employment taxes, not income taxes.

An IRS employee seriously erred in assessing the payroll taxes and recording the lien.

When made aware of the error, the IRS corrected the situation.

Peymon is still zero-for-all in matters that count.

The liens related to employment taxes, not income taxes.

An IRS employee seriously erred in assessing the payroll taxes and recording the lien.

When made aware of the error, the IRS corrected the situation.

Peymon is still zero-for-all in matters that count.

Taxes are the price we pay for a free society and to cover the responsibilities of the evaders

-

Pottapaug1938

- Supreme Prophet (Junior Division)

- Posts: 6108

- Joined: Thu Apr 23, 2009 8:26 pm

- Location: In the woods, with a Hudson Bay axe in my hands.

Re: $300,000 Income Tax Reward (Peymon Mottahedeh)

Peymon is like a baseball manager who talks about how his players put together three straight hits, in the third inning, and two straight in the second and fourth innings -- and glosses over the fact that those baserunners all got erased by double plays and forceouts, and that his team lost, 13-0.

"We've been attacked by the intelligent, educated segment of the culture." -- Pastor Ray Mummert, Dover, PA, during an attempt to introduce creationism -- er, "intelligent design", into the Dover Public Schools

-

wserra

- Quatloosian Federal Witness

- Posts: 7567

- Joined: Sat Apr 26, 2003 6:39 pm

Re: $300,000 Income Tax Reward (Peymon Mottahedeh)

We should thank him for coming. It did give us the occasion for some much-needed, um, focus.

Think we should move the thread to the Promoters forum?

Think we should move the thread to the Promoters forum?

"A wise man proportions belief to the evidence."

- David Hume

- David Hume