Education Associates, Inc.

A Non-Profit Corporation

|

Quatloos! > Tax Scams > Tax Protestors > EXHIBIT: Constitutional/Pure Trusts EXHIBIT: Constitutional Trusts & Pure Trusts NEW! -- United States v. Peter Anthony Bond Jutice Department Sues to Shut Down Alleged Tax Scams California Attorneys Plead Guilty to Promoting Tax Fraud Scheme in Utah Defendant Sentenced for Role in Tax Evasion Scheme Common aliases by scam artists who sell these: Pure Trusts -- Patriot Trusts -- Contract Trusts -- Freedom Trusts -- Business Trust -- Unincorporated Business Trust -- Equipment Trust -- Service Trust -- Final Trust -- Common Law Trust Organizations (COLATOS) -- Foreign Common Law Trust Organizations (FORCOLATOS) -- GPG Trust -- Complex Trust System

Generally

Read IRS-CID Warning on Abusive Trusts The Idiotic Sham Basis Behind This Fraud

The Letter

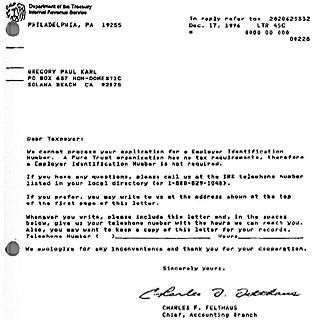

Please note that the letter states that a "Pure Trust organization has no tax requirements." It does NOT say that income to the Pure Trust is not taxable. It does NOT say that income earned by a Pure Trust can be retained in the Pure Trust. It does NOT even say if a Pure Trust exists!What the IRS doesn't explain in this letter is that the IRS treats Pure Trust organizations as if they do not exist, and that the individuals who are involved with it are themselves responsible for the tax. In other words, if you transfer your business earnings to a Pure Trust organization and it makes $100,000 in a year, then YOU (and NOT the Pure Trust) are responsible for paying taxes on the $100,000. If you do not pay the tax on any income or other taxable activity within the Pure Trust then you are committing criminal tax evasion! Anyone who claims differently is a liar and a scam artist.Additionally, please note that private letters, such as the one given above, do not have either precedent or evidentiary value -- i.e., you cannot introduce the above letter in court to prove that you are not guilty of criminal tax evasion.The Upshot: Anybody who presents this letter to you as "proof" that no taxes have to be paid for these entities is either a scam artist or is incredibly ignorant.What does the IRS really say about these trusts? Read below. IRS Warnings The U.S. Internal Revenue Service has repeatedly warned about these types of trusts (and, despite promoter's claims, the IRS has NEVER lost a case against the so-called Constitutional Trust or Pure Trust), so if you get caught using one you're either going have to shoot it out with the Service, flee the country, or -- more likely -- pay hefty fines and perhaps spend some time in the joint for tax evasion.See IRS Warnings About Fraudulent and Abusive TrustsSee IRS-CID Warning on Abusive Trusts Other Lies About Pure Trusts and Constitutional Trusts The scammers who sell these things make all sorts of misleading, and often bizarre claims regarding purpose trust. For instance:

Cases! Cases! Visit any of the sites which hawk Pure Trusts and/or Constitutional Trusts and you're likely to see a long list of "authorities" -- a couple of pages long and two- or three-hundred cites relating to "Pure Trusts" and such. Don't be misled by these -- they are NOT authority for, really, anything. What they are is a strange hodgepodge of court cases which seem to relate to "Pure Trusts", but almost all of which are taken out of context.Many of these authorities consider situations where the court was faced with a business entity which was half-partnership and half-trust, or half-corporation and half-trust, i.e., so called "hybrid" entities. To distinguish these from entities which are 100% partnership, corporation or trust, the courts used language such as "that is a 'pure' trust" for the non-hybrid entities. This would be like the court comparing a bucket of water & oil with a bucket of water and saying that the bucket of water & oil is different from the bucket of "pure" water. Does that mean that there is a difference between "pure" water and water? Of course not -- and it is ridiculous to assert such a thing. But that is exactly what the scam artists have done to create a "pure" trust.Moreover, going through the pure trust and constitutional trust websites, you see quite a few authorities from the turn of the century, but very, very few cases from the last 25 years, and almost no cases from the last decade. This is because, additionally, the laws have changed to make trusts overall (and not any particular breed of trust) less attractive for any planning purposes. As discussed above, even if you could create a pure trust or constitutional trust (you can't), it wouldn't give you ANY benefit because the Internal Revenue Code has obliterated any possibly tax benefit from using them, and no state court will recognize them for asset protection purposes.Which brings me to my point: What's the use of even arguing about these authorities when no court will recognize them. The scam artist might argue until he is blue in the face and convince you that there might be a thing called a pure trust or a constitutional trust, but what's the point of having one if no court will recognize them? So, how do you deal with the scam artists who sell these? Easy:THE BOTTOM LINE: ASK THE SCAM ARTIST WHO IS TRYING TO SELL YOU A PURE TRUST OR CONSTITUTIONAL TRUST TO GET YOU AN IRS DETERMINATION LETTER STATING THAT THE TRUST WILL GIVE YOU THE TAX BENEFITS THE SCAMMER IS PROMISING YOU. OR, MAKE HIM GET YOU A LEGAL OPINION LETTER FROM ONE OF THE BIG 5 ACCOUNTING FIRMS. IF HE CAN'T GET YOU ONE OF THOSE, YOU CAN ACCURATELY JUDGE THE LEGITIMACY OF THE TRUST HE IS TRYING TO SELL YOU (WHICH IS NONE). If you are approached about setting up a Do the rest of us a BIG favor. Contact the following:

If you don't alert the scammers that you have contacted these authorities, you might be able to help them "sting" the scammers, and at least then prevent other people from being hurt by this scam. If you have been scammed into forming a Contact your local tax attorney immediately (be careful about going to a CPA because you communications might not be protected by an effective privilege, and now you are in a possible criminal circumstance). IRS Victorious Against Pure Trust Promoters And Users Against the "trusts that the U.S. government are afraid to take to court" (according to the Pure Trust sellers' BS), the Internal Revenue Service in the year 2000 has had an impressive and unbeaten string of victories. Read the following article:

Pure Trust Promoters Some of the groups that promote the Pure Trust scam (Our friends in law enforcement please take note!). A few of these people are just too stupid to know what they are selling, and the rest are pure scam artists:

If you know of other groups which are promoting this scam, please advise us by our online form. If you have a "Pure Trust" from any of the above groups, there is a good chance that you have committed felony tax evasion. You should consult with a licensed tax attorney in your area immediately to try to back you out of the structure before you get caught COLATOS AND FORCOLATOS Some of the scam artists who sell Pure Trusts have figured out that there is too much information available on Pure Trust scams, so they have re-named their Pure Trusts as "COLATOS" (Common Law Trust Organizations) and "FORCOLATOS" (Foreign Common Law Trust Organizations). Don't be mislead: A scam by any other name is still a scam. Although the fraudsters will try to tell you that their "COLATOS" are "better" or "superior" to the old Pure Trusts, it just ain't so. The "COLATOS" and "FORCOLATOS" are every bit the worthless junk that Pure Trusts are, and essentially the very same scam. CASES WHERE PURE TRUSTS WERE ANNIHILATED The following is a partial list of cases where Pure Trusts were blown up. The scam artists who sell Pure Trusts will tell you the lies that "They have never lost in court" and "The IRS and creditors are afraid of them." Of course they have to tell you that because if they didn't there is no way you would buy one from them. But as shown, these are complete and total lies, and there is no merit whatsoever to the Pure Trust, as the following cases show what REALLY happens when the Pure Trust meets the IRS (and it ain't pretty for the people who have formed Pure Trusts:

FURTHER INFORMATION

ON PURE TRUST SCAMS Well-respected tax attorney Bob Sommers has put together a series of articles dealing with these inane and ineffective trusts.

Mark Pitcavage Expose of Pure Trusts Mark Pitcavage, PhD, of the MilitiaWatchdog group, has written an excellent expose of the Pure Trust promotes and the lies they spin to sell Pure Trusts.

Vern Jacobs and Richard Duke Two of America's best planner discuss Pure Trust scams at great length.

Roger M. Wilcox

Internal Revenue Service

|

Detroit

Free Press E. Lansing couple An East Lansing couple charged with hiding more than $600,000 in sham trust funds and failing to file their taxes could face more than 15 years in prison and $1 million in fines. Gerald Thomas Mann, a 51-year-old Lansing dentist, and Laurel Rose Mann, 49, are charged with three felony counts of tax evasion and three misdemeanor counts of failure to file taxes. They are expected to be arraigned Friday in a Grand Rapids federal court. "The sham trusts are increasing problems throughout the country resulting in increased IRS attention,'' Assistant U.S. Attorney Donald Davis said Monday. The Manns are charged in the 1993, 1994 and 1995 tax years, said Mark Kroczynski, special agent for the Internal Revenue Service. During that time, they earned about $671,000, he said. But they also didn't file federal or state income tax returns from 1993 through 2000, he said. "Our investigations normally take awhile and many times by the time they are completed you may have subsequent years that are past,'' Kroczynski said. Gerald Mann is being held in Newaygo County Jail and couldn't be reached for comment. He was arrested Thursday in his Lansing office by IRS agents. Laurel Mann, who works for Michigan State University, was at one of her children's sporting events when she was arrested. Officials didn't hold her because she's not a flight risk, Davis said. Mann said her husband did the taxes. She said she doesn't know

how they will plead. The couple had a court hearing Monday but nothing happened because they didn't have a lawyer, Davis said. It will continue Friday. IRS officials say the Manns put the dental practice into the "Holmes Dental Clinic Trust," the business real estate into the "Burroughs Holding Trust," a personal residence into the "Nazareth Security Trust," and a business checking account into the "Red Cedar Audubon Trust'' in Belize. According to the indictment, the couple put money from the dental practice and their retirement into the Belize fund, then transferred that to a Swiss bank account. Kroczynski said many people, in similar cases, say the trust earned money rather than themselves. "The people feel consequently that they are not liable for

tax,'' he said. "It will be up to a jury to decide if they are subject to the tax laws of this country,'' he said. "Our contention is they are. That's why we recommended prosecution." Visit Our Friends

Riser

Adkisson LLP Tax

Protestors, Pure Trusts, and Other Stupid De-Tax Schemes & Scams Tax Practice & Policy and Tax Shelters Practical and Practice issues for Professionals who practice in the area of taxation. Moral, social and economic issues relating to taxes, including international issues, the U.S. Internal Revenue Code, state tax issues, etc. New Scam! http://www.assetpro.us -- Offers the "Federal Contract Trust" which is simply a re-packaged Pure Trust scam. Very cheesy website, and they charge an absurd $4,995 for a type of trust that doesn't even exist! | link Claims to be run by Richard Young, 2915 W. Charleston

Blvd., #7, Las Vegas, Justice Indicts Nine Promoters of Alleged Abusive Trust Scheme -- Operators, Salesmen of Innovative Financial Consultants Charged with Tax Fraud. Summary of Abusive Trust Schemes -- Released by the IRS Criminal Investigation Division. Foreign Source Income Scam -- Douglas P. Rosile, Sr., is chased by Justice Department for tax scam based on "an absurd reading of Section 861 of the Internal Revenue Code", which supposedly allowed people to not report their income unless it was from outside the U.S. Pure Trusts/Common Law Trusts = More Convictions -- Recap of about a dozen people so far this year who have sent to the pokey for selling Pure Trusts or Common Law Trust Organizations. So far, Pure Trusts are batting .000 career against the IRS. Liberty Estate Planning Network, Association for Certified Estate Planning Attorneys and Eagle Publications Trust -- U.S. Justice Department sues to stop fraudulent organizations run by Michael D. Richmond and Rex E. Black of the Chicago area from marketing sham trust packages employing bogus "Pass-Through Technology". Justice Department Slams Pure Trust Promoters -- The trusts that the U.S. government was supposed to be "afraid to challenge" are once again slammed, this time by the Justice Department, and no doubt supported by the IRS to get the names of tax evaders who have been using Pure Trust Organizations and Business Trusts, with the idea of collecting lots of back taxes, interests, and penalties. Justice Department Cracks Down on Pure Trusts -- Pure trust promoters around the country are charged with criminal tax evasion and serious prison terms for selling Pure Trusts a/k/a Freedom Trusts, Constitutional Trusts, Common Law Trust Organizations (COLATOS), and similar names. |

||||||||||||||||||||||||||||

|

JUSTICE DEPARTMENT SUES TO SHUT DOWN ALLEGED TAX SCAMS Sham Trusts, False Claims

of Tax-Exempt Status WASHINGTON, D.C. - The Justice Department announced today that it has filed a civil suit seeking to stop Raymond Leo Bell, American Beauty Rose, and The Best Way, Inc., all of Yelm, Washington, from promoting fraudulent tax schemes that use sham trusts and other sham entities. According to the government's complaint, Bell helps his customers set up sham trusts and corporations that customers use illegally to eliminate or reduce their federal tax liabilities and to evade IRS collection efforts. The complaint also alleges that the defendants advise customers to falsely claim tax-exempt status for their businesses and to fabricate and inflate improper deductions in a fraudulent attempt to evade income and employment taxes. The government's complaint seeks to prohibit defendants from selling any type of arrangement that advocates or facilitates tax evasion or non-compliance with the income tax laws. The complaint also seeks an order directing the defendants to notify their customers of the complaint and any injunction entered by the court, and to provide to the Department of Justice the names, mailing and e-mail addresses, phone numbers, and Social Security or employer identification numbers of any customers who had purchased the firms' products. "Stopping tax-scam promotions is a high priority for the Justice Department," said Eileen J. O'Connor, Assistant Attorney General for the Department of Justice's Tax Division. "In addition to shutting down tax scams, we are committed to identifying those who, by using them, have risked civil penalties and, where appropriate, criminal prosecution." Misuse of trusts tops the IRS's recent list of "Dirty Dozen" tax schemes. Information about the "Dirty Dozen" tax schemes is available at: http://www.irs.gov/newsroom/article/0,,id=120803,00.html. More information about the Justice Department's efforts against tax-scam promoters can be found at: http://www.usdoj.gov/tax/taxpress2004.htm. Information about the Justice Department's Tax Division can be found at http://www.usdoj.gov/tax. |

CALIFORNIA ATTORNEYS

PLEAD GUILTY TO PROMOTING Defendants Fraudulently Claimed Placing Assets in Trust Would Reduce Taxes WASHINGTON D.C. - Eileen J. O'Connor, Assistant Attorney General for the Tax Division, Department of Justice; Paul Warner, U.S. Attorney for the District of Utah; Nancy Jardini, Chief, Internal Revenue Service Criminal Investigation Division; and James H. Burrus, Jr., Special Agent-in-Charge, SLC Division, Federal Bureau of Investigation announced today that at the federal courthouse in Salt Lake City, Utah, California attorneys Martin Arnoldini and Jerrold Boschma each pled guilty to a felony charge of conspiracy to commit mail and wire fraud and to defraud the Internal Revenue Service (IRS) (18 U.S.C. § 371). Arnoldini and Boschma each face a maximum potential sentence of five years imprisonment followed by up to three years supervised release, a $250,000 fine and liability for the costs of prosecution. No sentencing dates were set. "People who try to conceal their income from the IRS can lose their money to con artists who make a living selling tax scams," said Assistant Attorney General Eileen J. O'Connor. "Participants in fraudulent tax schemes may face criminal prosecution, and they still will have to pay their taxes, along with interest and civil fraud penalties." "As this year's tax filing deadline approaches, the pleas taken in this case serve as timely reminders that fraudulent tax schemes such as these will be investigated and prosecuted to the fullest extent of the law," said U.S. Attorney Paul M. Warner. "Residents of Utah who have filed or are now filing their state and federal tax returns and paying their fair share of taxes need to be reassured that we will aggressively pursue those who do not." "One of the IRS's enforcement priorities is to ensure that attorneys, accountants and other tax practitioners adhere to professional standards and follow the laws," said Nancy Jardini, Chief, IRS Criminal Investigation. "Concealing income from the government through the use of fraudulent trust arrangements is not financial planning; it is illegal. Those who promote these activities or willfully invest in these schemes will be held accountable." Arnoldini and Boschma, who were charged by Information, admitted that they, along with previously indicted coconspirators, promoted and sold a fraudulent "trust" scheme to approximately 300 clients. The Information alleges that Arnoldini and Boschma are attorneys licensed to practice law in California, partners in Century Law Offices in Valencia, California, and that Mr. Arnoldini also holds an advanced degree in taxation. It also alleges that they and their coconspirators defrauded investors of approximately $7 million. As a condition of their guilty pleas, Arnoldini and Boschma agreed to surrender their law licenses. Arnoldini and Boschma admitted in their plea agreements that beginning in 1997, they promoted and sold a fraudulent "trust" scheme designed to evade federal income taxes. They admittedly marketed the scheme through their Century Law Offices, and as licensees of World Contractual Services and, later, through CornerStone West. They also admitted that, with their coconspirators, in seminars and through promotional materials and opinion letters, they fraudulently misrepresented to customers that their tax liabilities could be lawfully reduced by placing businesses, homes, investments and other assets into a trust's name. They admitted that they, with their coconspirators, caused the preparation of false and fraudulent federal income tax returns. Messrs. Arnoldini and Boschma admitted their actions caused losses of federal tax revenue totaling approximately $3.6 million. Arnoldini and Boschma also admitted participating in fraudulent investment schemes, helping cause customers to lose approximately $1.3 million. They said most of the customer funds were allegedly wired to offshore banks, purportedly to be placed in a foreign investment. They admitted they knew the investment would place the customers funds at considerable risk and would never pay any return. Assistant Attorney General O'Connor thanked Tax Division trial attorneys Albert Kleiner, Nicholas Dickinson, and Kevin Downing, who prosecuted the case. She also thanked the special agents of the Internal Revenue Service and Federal Bureau of Investigation whose assistance was essential to the successful investigation and prosecution of the case. On March 18, 2004, Todd Cannon and Lance Hatch pleaded guilty to a conspiracy charge in connection with this case. On April 6, 2003, David Orr and Michael Behunin, an attorney with an advanced degree in tax law, also pled guilty to conspiracy charge. Lanny White and Max Lloyd are under indictment and awaiting trial on related charges. The charges contained in an indictment are only allegations. In the American justice system, a person is presumed innocent unless and until proven guilty in a court of law. |

FOR

IMMEDIATE RELEASE

|

For Immediate Release DEFENDANT SENTENCED FOR ROLE Tampa - On February 6, 2004, United States District Judge Richard A. Lazzara, sitting in Tampa, Florida, sentenced MICHAEL J. MARICLE, age 48, of Palm Harbor, Florida, to a term of imprisonment of thirty (30) months upon his conviction of two counts of aiding in the preparation and filing of false income tax returns, in violation of Title 26, United States Code, Section 7206(2). MARICLE, a Certified Public Accountant in Clearwater, Florida, pled guilty to those two charges on March 5, 2003. He pled guilty to assisting two different tax payer clients in filing false income tax returns which disguised large sums of income which those tax payers had earned in 1998. MARICLE had prepared their tax returns in connection with his role as a promoter of the AEGIS system, a scheme which entailed the use of abusive trusts in order to hide income and evade the payment of income taxes. In addition to his sentence of imprisonment, MARICLE was ordered to assist the Internal Revenue Service in the computation and collection of all taxes due and owing on the part of his two clients. This case was prosecuted by Jay L. Hoffer, Assistant United States Attorney, Deputy Chief, Special Prosecutions Section of the Tampa Division. This case was investigated by the Internal Revenue Service - Criminal Investigation Division. |

JUSTICE INDICTS NINE PROMOTERS

Operators, Salesmen of Innovative

Financial Consultants WASHINGTON, D.C. - Eileen J. O'Connor, Assistant Attorney General of the Justice Department's Tax Division, Paul K. Charlton, U.S. Attorney for the District of Arizona, and David B. Palmer, Chief, Internal Revenue Service, Criminal Investigation, today announced the indictment of nine individuals for conspiracy to defraud the Internal Revenue Service by marketing alleged abusive trusts through an organization known as Innovative Financial Consultants (IFC). On April 4, 2003, a federal grand jury sitting in the District of Arizona indicted the following individuals for conspiracy to defraud the United States in violation of 18 U.S.C. Section 371:

The indictment, which was unsealed today, alleges that the defendants sold various trust packages for financial gain by falsely claiming that taxpayers could lawfully avoid income taxes by placing their income and assets into either an "onshore" or "offshore" trust package. IFC sold the offshore trust package for approximately $10,500 and the onshore trust package for approximately $4,154, according to the indictment. The indictment states that IFC records reflect the creation of approximately 3,000 "pure trust organizations," which the government alleges were bogus trusts, between September 1996 and February 2001. However, according to the indictment, IFC enabled their clients to retain the use, control and dominion of any income and assets they placed into their respective trusts while making it difficult or impossible for the IRS to track the true ownership of assets or income assigned to the "trusts" or deposited into trust bank accounts. The indictment alleges that Dennis Poseley and Patricia Ensign, were the founders and operators of IFC, and that Jeffrey G. Lewis and Keith D. Priest were "trustees." John F. Poseley, Mark D. Poseley, David W. Trepas, Rachel McElhinney allegedly worked as IFC salespeople; Frank C. Williams prepared tax returns for IFC clients referred to him by the sales team, according to the indictment. The IFC trust packages were promoted and sold at presentations throughout the United States and internationally, as well as through telephone conference calls for prospective clients and at an Internet website. An indictment is merely an accusation. Defendants are presumed innocent until and unless proven guilty. This prosecution is the result of an investigation by the IRS Criminal Investigation. The prosecution is being handled by trial attorneys Edward E. Groves, Larry J. Wszalek, and Mark T. Odulio of the Justice Department's Tax Division. To search the ABA-PTL archives online or manage your subscription, go to http://mail.abanet.org/ archives/ aba-ptl.html |

CHICAGO FEDERAL COURT BLOCKS Court's Order Backs IRS-Justice Department Crackdown WASHINGTON, D.C.- The Justice Department announced that a federal court in Chicago today barred Rex E. Black of Beecher, Ill. from selling fraudulent trust plans used to evade federal income taxes, and told him to post the court's order on the Internet. It also ordered him to turn over his lists of customers, and banned him from preparing federal income tax returns. In addition, the order applies to affiliated organizations that Black has used to promote the trust schemes-The Liberty Network, Liberty Estate Planning, The Liberty Institute, Fiduciary Management Group, The National Council of Certified Estate Planners, Association for Certified Estate Planning Attorneys and Eagle Publications Trust. "We are pleased that the court shut down this major scam, and that Mr. Black was ordered to post the injunction on his Internet sites. The Internet makes selling these kinds of tax scams remarkably easy, but the Department's Tax Division is going to use the Net to find and shut them down," said Eileen J. O'Connor, Assistant Attorney General for the Department's Tax Division. "People who are thinking of cheating on their taxes should be on guard - substantial civil and criminal sanctions may be imposed on those who participate in abusive schemes, and we will continue to pursue promoters who sell them." Last year, 45 people were convicted for tax evasion for selling or using phony trusts. Defendants who were sentenced to prison faced sentences averaging more than five years. As of December 31, 2001, the IRS had 160 open criminal investigations involving trust schemes. The IRS estimates that fraudulent trust schemes cost the public about $3 billion in lost revenue each year. According to papers the Justice Department filed in the case, Black and his organizations help customers violate federal tax laws by purporting to transfer their income and assets to bogus trusts. They also advise customers to claim tax deductions for such non-deductible items as depreciation on their homes. The government's court papers further claimed that Black's "Liberty Institute" has trained over 2,500 people nationwide through "certification" courses resulting in a "Certified Estate Planner" designation. Upon "certification," Liberty agents then sell trust packages to customers for fees as high as $3,750, plus additional annual charges for tax return preparation, "trustee services," and secretarial services. Court papers showed that Black's National Association of Certified Estate Planners claims to have 730 Certified Estate Planners in 39 states. The IRS estimates that Black's activities cost taxpayers more than $9 million per year. Today's court order requires Black to:

The Justice Department has moved in the same case for a preliminary injunction against one of Black's associates, Michael D. Richmond. The court has allowed Richmond, who, according to court papers is currently in prison, additional time to respond to the lawsuit. A similar injunction case is pending in federal court in Boston against Kevin Mahoney, allegedly one of Black and Richmond's associates. ### 02-355 |

UNITED STATES COURT OF APPEALS |

© 2002- by Quatloosia Publishing LLC.. All rights reserved. No portion of this website may be reprinted in whole or in part without the express, written permission of Financial & Tax Fraud Associates, Inc. This site is http://www.quatloos.com. Legal issues should be faxed to (877) 698-0678. Our attorneys are Grobaty & Pitet LLP (http://grobatypitet.com) and Riser Adkisson LLP (http://risad.com).

|

|

| www.assetprotectionbook.com | www.farbook.com |

Website designed and maintained by John Barrick